Retirement: Real‑World Advice for Your Next Chapter

Retirement feels like a big shift, but it doesn’t have to be scary. You’ve spent years working hard, so now it’s time to plan how you’ll enjoy the years ahead. This guide breaks down the most useful steps you can take right now, whether you’re just thinking about retirement or already counting down the days.

Planning Your Finances

The first thing everyone asks about is money. Start by listing every source of income you expect after you stop working – state pension, private pensions, savings, investments, and any side gigs you might keep. Knowing the exact numbers helps you set a realistic budget.

Next, look at your expenses. Separate the essentials (housing, utilities, food, health care) from the extras (travel, hobbies, dining out). If the extras seem too high, trim them a bit now so you won’t feel the pinch later. A simple spreadsheet can do the trick; you don’t need fancy software.

Don’t forget inflation. Even a modest 2‑3 % rise each year can eat into your savings. One way to protect yourself is to keep part of your portfolio in assets that grow with inflation, such as index funds or property.

Consider an emergency fund that covers at least six months of living costs. It should stay in an easily accessible account – a high‑interest savings account works well. This buffer stops you from dipping into retirement cash for unexpected repairs or medical bills.

If you’re unsure about the numbers, a quick chat with a financial adviser can clear things up. Many advisers offer a free first session, and they can help you spot gaps you might have missed.

Living the Retirement Life

Money aside, think about how you want to spend your days. Some retirees love travel, others enjoy learning new skills, and many just relish more time with family. Write down a few activities that excite you – a hobby you’ve postponed, a place you’ve always wanted to visit, or a class you’d like to try.

Staying active is key. Regular walks, light workouts, or community sports keep your body fit and your mind sharp. You don’t need a gym; a park bench or a home‑based routine can do the job.

Social connections matter too. Join a club, volunteer, or attend local events. These interactions give you a sense of purpose and help prevent the loneliness some retirees feel.

If you plan to move, weigh the pros and cons. Downsizing can free up cash and reduce upkeep, while staying in your current home keeps you close to familiar neighbors. Think about health care access, transport options, and whether the area suits your lifestyle goals.

Finally, keep a flexible mindset. Plans change, and that’s okay. Some retirees discover new passions years into retirement, and adjusting your budget or schedule is part of the journey.

By tackling finances early and picturing how you want to live, retirement becomes a chapter you can look forward to instead of a unknown. Take one step today – maybe it’s opening a spreadsheet, signing up for a weekend class, or simply jotting down three things you’d love to do. The sooner you start, the smoother the transition will feel.

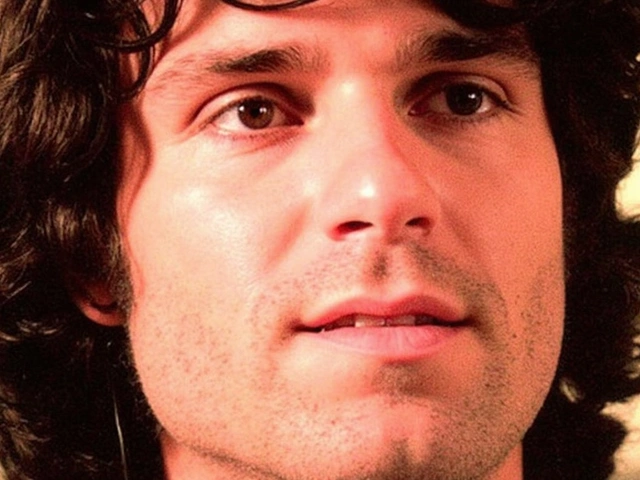

Adam Lallana Announces Retirement After Decorated Liverpool Career, Moves Into Brighton Coaching Role

Adam Lallana, a vital figure from Liverpool’s golden era under Jurgen Klopp, has retired after 20 years in football. He leaves behind a Premier League and Champions League legacy, and now steps into coaching at Brighton, aiming to shape the club's next chapter.