Economic Hurdles for the UK

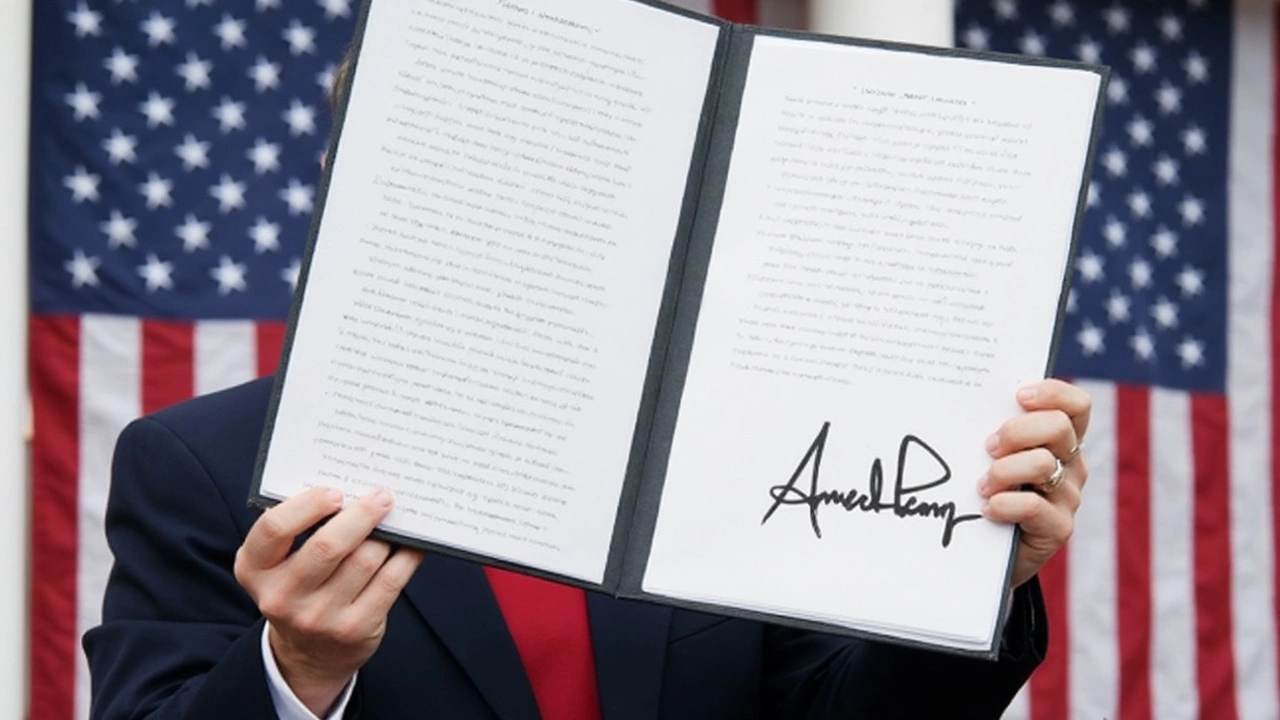

The recent decision by Donald Trump to implement a 10% tariff on imports has stirred considerable concern in the UK. The economic landscape is bracing for impact, with forecasts pointing to a bumpy ride ahead. Oxford Economics has revised its predictions, lowering UK growth expectations to just under 1% for 2025, sliding from previously hopeful estimates of 1.5%. The root of this downturn? It’s mainly the softened demand from both the US and the global market. Even though there's no direct penalty on UK exports, the country's trade with the US, including cars, spirits, and other alcoholic beverages, is feeling the heat.

Impact on Households and Sectors

We've all heard about market fluctuations affecting our wallets, but this round of tariffs adds a twist. Personal finance experts suggest that while some products might see lower prices due to diverted US shipments, it’s not all rosy. Companies might hike prices worldwide to make up for tariff-related costs. It's like that unpredictable wave you didn't see coming. Sarah Coles from Hargreaves Lansdown mentions that currency shifts and competitive pricing could create a roller-coaster experience at the checkout.

Then there’s the industry-specific squeeze. Think about the UK car manufacturers for a second—they rely heavily on the US market, their second-largest after the EU. With reduced demand looming, job security within the industry is at risk. The scotch whisky sector and other transatlantic trade players are also tiptoeing around market volatility. And let's not forget the housing scene. As Richard Donnell from Zoopla points out, slowing economic momentum might keep borrowing costs high, putting a squeeze on those hoping for a rate cut from the Bank of England.

Despite all these challenges, the UK government seems to be taking the path of least resistance, opting against retaliatory tariffs. The Bank of England might hold back on reducing rates amid inflation-induced uncertainties. Meanwhile, the Office for Budget Responsibility will likely adjust its growth and borrowing expectations thanks to these tariff changes.

Over in the US, the Trump administration stands by its stance, arguing that tariffs are crucial to addressing hefty trade deficits and spurring domestic manufacturing. There are claims of past tariffs bolstering US production without sparking inflation, though the IMF warns that global economic growth might take a hit—potentially by 0.5% by 2026. All these movements create a backdrop of broader economic unpredictability, which could eventually force policymakers to tweak fiscal strategies.

The global stage waits with bated breath, watching as these tariffs unfold, potentially reshaping trade patterns and affecting economies beyond the immediate players. It’s like a ripple effect in a pond—one that could complicate economic recovery and redefine global commerce as we know it.